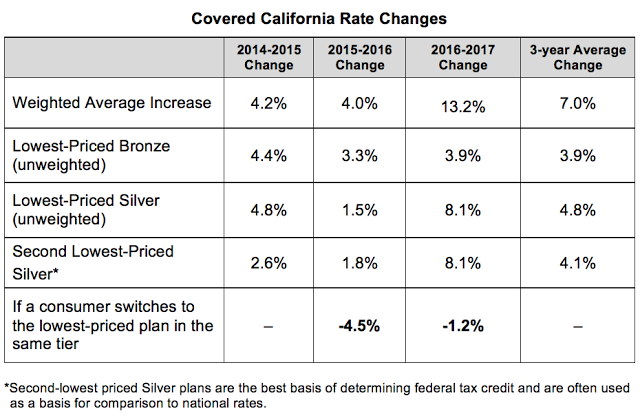

The Covered California insurance rate is set to increase an average of 13.2% statewide. Executive Director Peter V. Lee attributes the increases to the rising cost of health care, end of funding mechanisms designed to moderate rate increases, and increase in both demand and enrollment of those initially left out of the Affordable Care Act.

The Affordable Care Act created several programs to provide a comfortable market for health care providers and consumers alike, namely: “the risk adjustment, reinsurance and risk corridors programs (referred to as the premium stabilization programs), the cost-sharing reductions program, and Marketplace affordability programs such as advance payments of the premium tax credit.” (The Center for Consumer Information and Insurance Oversight. 2016)

Premium Stabilization Programs

“The transitional reinsurance program is a three-year program designed to reduce premiums and ensure market stability for issuers and thereby reduce premiums for enrollees in the individual market to ensure market stability with the implementation of new consumer protections in 2014.” (The Center for Consumer Information and Insurance Oversight. 2016)

Source: Covered California. (2016, July 19). Covered California Announces Rates and Plan Expansions for 2017. Retrieved July 19, 2016, from http://news.coveredca.com/2016/07/covered-california-announces-rates-and.html

Small Businesses interested in providing insurance through Covered California may qualify for federal tax credits to offset part of their costs for two consecutive years: up to 50 percent of premium expenses or 35 percent for tax exempt organizations. (Covered California. Fact Sheet: Covered California for Small Business. Accessed July 19, 2016) Detailed information and resources below.

Is My Business Eligible for Covered California?

- You have 100 or less eligible employees

- You have fewer than 25 Full Time Employees (FTEs)

- Your Average Employee Wage is: $50,000 / Year (Adjusted for inflation beginning 2014)

- You have at least one employee that is not the owner or spouse that receives a W-2

- Your Employer Contribution is: At least 50% of Employee Premiums

How to Claim Tax Credits

- IRS Form 8941

- Tax-Exempt Organizations must also fill out: IRS Form 990-T

Works Cited

Covered California. (2016). 2016 Standard Benefits Covered California for Small Business. Retrieved July 19, 2016, from http://www.coveredca.com/forsmallbusiness/plans/PDFs/2016HealthPlanBenefitsSummary.pdf

Covered California. (2016, July 19). Covered California Announces Rates and Plan Expansions for 2017. Retrieved July 19, 2016, from http://news.coveredca.com/2016/07/covered-california-announces-rates-and.html

Covered California. (2016). Covered California for Small Business. Retrieved July 19, 2016, from http://www.coveredca.com/forsmallbusiness

Covered California. (2016). Covered California for Small Business: How to Apply. Retrieved July 19, 2016, from http://www.coveredca.com/forsmallbusiness/apply

Cooper, J. J. (2016, July 19). Covered California proposes 13 percent premium increase. Retrieved July 19, 2016, from http://www.sacbee.com/news/article90458917.html

Covered California. (2016). Fact Sheet: Covered California for Small Business. Retrieved July 19, 2016, from http://hbex.coveredca.com/toolkit/PDFs-Collateral/2015-fact-sheet/OE3_Small-Business_Fact-Sheet_English-Interactive.pdf

Covered California. (2016). 2016 Plan Change Summary Covered California for Small Business. Retrieved July 19, 2016, from http://www.coveredca.com/forsmallbusiness/plans/PDFs/2016PlanChangeSummary.pdf

Covered California. (2016). Small Business Tax Calculator. Retrieved July 19, 2016, from https://coveredcaagent.pinnacletpa.com/smallbusiness_tcc

The Center for Consumer Information and Insurance Oversight. (2016). Premium Stabilization Programs. Retrieved July 19, 2016, from https://www.cms.gov/CCIIO/Programs-and-Initiatives/Premium-Stabilization-Programs/index.html